Disaster Rebuilding Assistance (DRA)

- About the Program

- How to Apply

- Nonmembers

- Resources

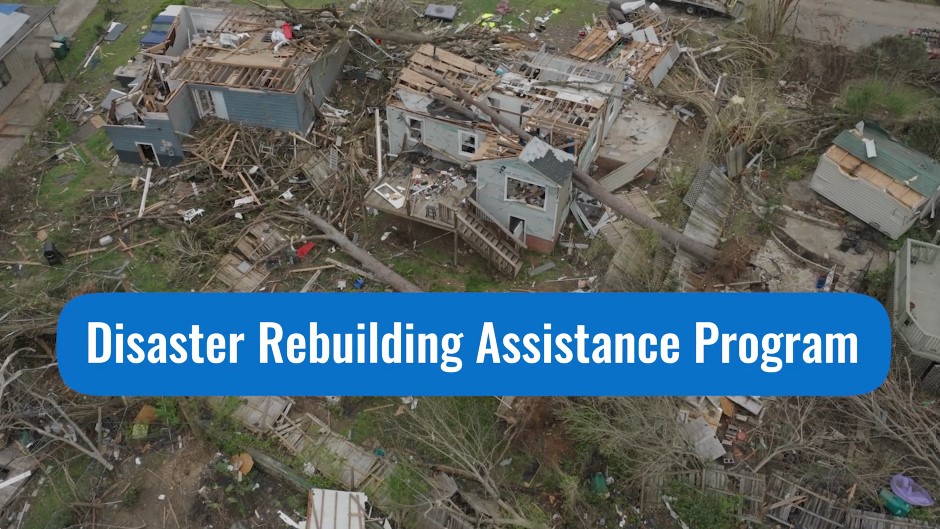

Disaster Rebuilding Assistance

When Disaster Strikes, FHLB Dallas is There

Program Overview |

FHLB Dallas’ Disaster Rebuilding Assistance (DRA) program provides grants for the repair, rehabilitation and reconstruction of owner-occupied housing affected by a disaster event in a federally declared disaster area within the FHLB Dallas District. The home must be located in a county/parish designated by FEMA for Individual Assistance no earlier than January 1, 2022. DRA funding benefits households at or below 80 percent of their area median income. For 2026, FHLB Dallas set aside $3.5 million of its AHP allocation for the DRA program. Funding is provided during two offering periods in February and August. Each is administered on a first-come, first-served basis until the funds are exhausted. Any remaining funds at the end of the first offering carry over to the second offering. Members may apply until November 15, 2026, or until the funds are exhausted, whichever occurs first. Available Funds as of February 27, 2026: $996,348.65Second Offering: August 3, 2026 with $1.75 million available Member Cap: $262,500 per offering |

How the DRA Can Help You

FEMA Disaster Declarations

FHLB Dallas has activated its Disaster Relief Program (DRP) and Disaster Rebuilding Assistance (DRA) programs in response to the FEMA Disaster Declarations below. Individuals and business owners located within FEMA-declared disaster areas may apply for the funds through FHLB Dallas member financial institutions. Due to the ongoing nature of disasters, subsequent counties may be added. For more detailed program information about both the DRA and DRP programs, visit the resources section on this page or contact Member Services at 844.345.2265.

Severe Storms, Flooding and Landslides in New Mexico – June 23, 2025-August 5, 2026

FEMA issued a disaster declaration for the period June 23, 2025, through August 5, 2025. Dona Ana and Lincoln counties are eligible for assistance. Check the Federal Emergency Management Agency (FEMA) website for potential updates. Advances are available through March 12, 2026.

Texas Severe Storms, Straight-line Winds and Flooding – July 6, 2025-July 18, 2026

FEMA issued a Disaster Declaration on July 6, 2025, for severe storms, straight-line winds and flooding that impacted multiple Central Texas counties. Members may apply for DRP advances through January 8, 2026.

Benefits for Your Financial Institution

Differentiate your institution by offering fast access to funding when disaster strikes.

Strengthen customer relationships and loyalty by providing funding to your customers and communities in a time of need.

Support economic and community development by helping households and businesses rebuild and recover from disaster situations.

Rebuilding Lives

Learn how FHLB Dallas helps people get back to business after a disaster.

Grant Provides Relief and New Roof for Longtime New Orleans Homeowner

Rebuilding New Orleans Together

Stories

Tell Us Your Story

To participate in the Disaster Rebuilding Assistance (DRA) program, FHLB Dallas members must complete the DRA Member Enrollment Application. The application includes the DRA Subsidy Agreement, which explains your obligations under the program.

The DRA Member Enrollment Application and DRA Subsidy Agreement must be signed by a person listed on the current Advances Signature Card on file with FHLB Dallas.

DRA funds are provided only through FHLB Dallas members. FHLB Dallas does not provide funds directly to consumers.

Program Requirements

To qualify for DRA funding, projects must meet the following criteria:

-

Households must have a family income of 80 percent or less of their area’s median income as defined by HUD.

-

The property must be located within the FHLB Dallas District and in an area designated for Individual Assistance by the Federal Emergency Management Agency (FEMA) no earlier than January 1, 2022.

- The repairs must be due to damages caused by the natural disaster. New in 2026: If the request is for roof replacement, the new roof must be a FORTIFIED roof unless the structure of the home cannot support a FORTIFIED roof.

-

Homeowner(s) must have ownership of the property at the time of request for DRA funds and must have had ownership of the property for at least 30 days prior to the related disaster.

-

Applications must include:

- An executed Home Repair Estimate form and a pre-rehabilitation inspection report supporting the amount of DRA funds requested.

- Verification of the completed rehabilitation work via a final invoice and a post-rehabilitation inspection report.

- Pre- and post-inspection reports prepared by an independent third-party selected by the member. Unless the intermediary is a government-controlled entity, the third-party inspector must not be related to the intermediary.

-

Homeowners may not receive any cash from the DRA grant.

The intermediary fee to the intermediary may not exceed $750.

Enroll to Apply for DRA Program

An individual from the FHLB Dallas member financial institution with current Advances Signature Card authorization must submit a one-time DRA Enrollment Application and Subsidy Agreement. Please email ahp@fhlb.com for the AdobeSign application.

After reviewing and approving your application, FHLB Dallas will notify you of your acceptance into the program.

Request DRA Funds

After completing the DRA enrollment process, members will be eligible to request DRA funds during each offering period. Submit your request(s) via GrantConnect..

For more detailed information about the DRA funding process, please refer to the DRA Program Funding Manual on the Resources page.

Disaster Rebuilding Assistance (DRA) funding must be submitted by an eligible FHLB Dallas member financial institution. FHLB Dallas does not funds directly to consumers. Homeowners or representatives of community-based organizations seeking DRA assistance must work with a participating FHLB Dallas member institution to apply for funds.

Please note that in addition to the approved, members have their own underwriting criteria and lending areas and may have reached their FHLB Dallas DRA program cap within a given year.

Find a Participating FHLB Dallas Member Institution

If you are a consumer or represent a community-based organization or similar entity seeking DRA assistance, use the link below to find a participating member in your area. Members are listed within the state of their charter’s origin and in alphabetical order.

Participating Members List