- October 29, 2018

Federal Home Loan Bank of Dallas Reports Third Quarter 2018 Operating Results

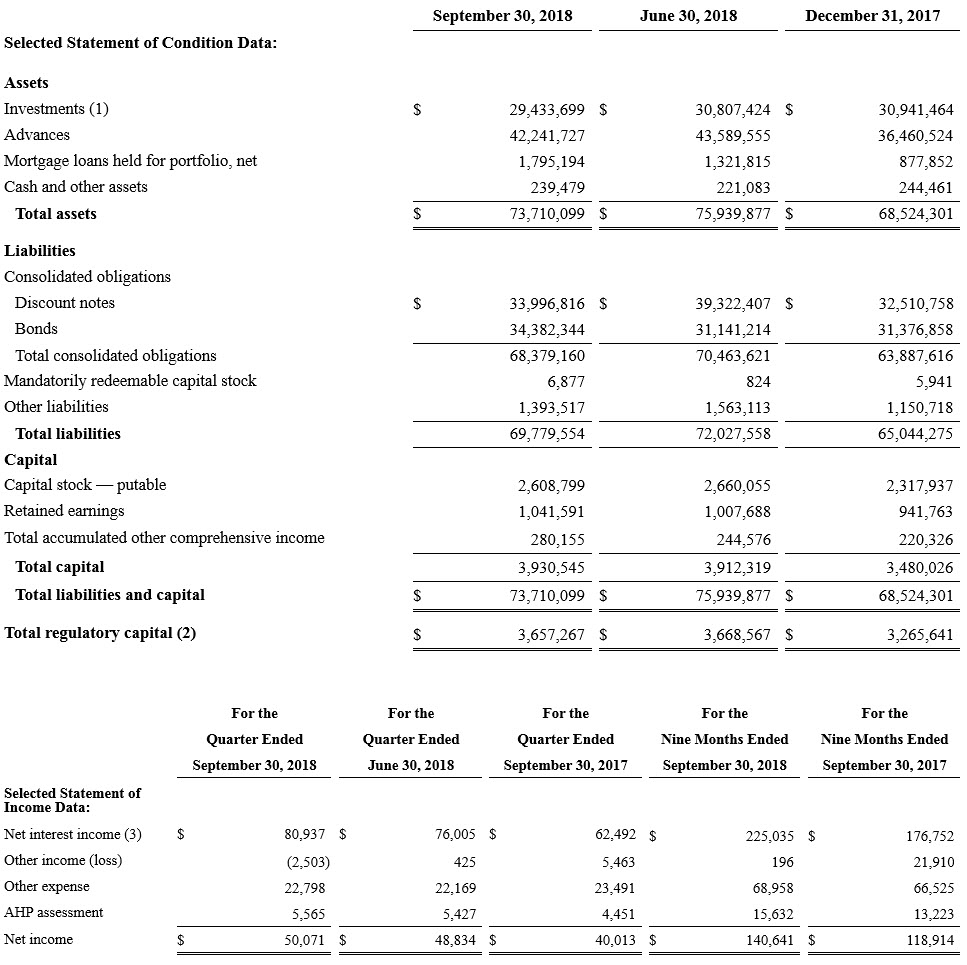

DALLAS, TEXAS, October 29, 2018 - The Federal Home Loan Bank of Dallas (Bank) today reported net income of $50.1 million for the quarter ended September 30, 2018. In comparison, for the quarters ended June 30, 2018 and September 30, 2017, the Bank reported net income of $48.8 million and $40.0 million, respectively. For the nine months ended September 30, 2018, the Bank reported net income of $140.6 million, as compared to $118.9 million for the nine months ended September 30, 2017.

The $1.3 million increase in net income from the second quarter of 2018 to the third quarter of 2018 was attributable to an increase in the Bank's net interest income ($4.9 million), offset by a negative swing in its non-interest income (loss) ($2.9 million), an increase in its non-interest expenses ($0.6 million) and an increase in its AHP assessment ($0.1 million).

The $10.1 million increase in net income for the third quarter of 2018, as compared to the third quarter of 2017, was attributable to an increase in the Bank's net interest income ($18.4 million) and a decrease in its non-interest expenses ($0.7 million), offset by a negative swing in its non-interest income (loss) ($7.9 million) and an increase in its AHP assessment ($1.1 million).

Total assets at September 30, 2018 were $73.7 billion, compared with $75.9 billion at June 30, 2018 and $68.5 billion at December 31, 2017. The $2.2 billion decrease in total assets for the third quarter was attributable primarily to decreases in the Bank's advances ($1.4 billion) and short-term liquidity portfolio ($1.6 billion), partially offset by increases in the Bank's mortgage loans held for portfolio ($0.5 billion) and long-term investments ($0.2 billion). The $5.2 billion increase in total assets for the nine months ended September 30, 2018 was attributable primarily to increases in the Bank's advances ($5.7 billion), long-term investments ($0.8 billion) and mortgage loans held for portfolio ($0.9 billion), partially offset by a decrease in the Bank's short-term liquidity portfolio ($2.2 billion).

Advances totaled $42.2 billion at September 30, 2018, compared with $43.6 billion at June 30, 2018 and $36.5 billion at December 31, 2017. The Bank's mortgage loans held for portfolio totaled $1.8 billion at September 30, 2018, as compared to $1.3 billion at June 30, 2018 and $0.9 billion at December 31, 2017.

The Bank's long-term held-to-maturity securities portfolio, which is comprised substantially of U.S. agency residential mortgage-backed securities (MBS), totaled approximately $1.6 billion, $1.8 billion and $1.9 billion at September 30, 2018, June 30, 2018 and December 31, 2017, respectively. The Bank's long-term available-for-sale securities portfolio, which is comprised substantially of U.S. agency debentures and U.S. agency commercial MBS, totaled $15.5 billion at September 30, 2018, as compared to $15.1 billion at June 30, 2018 and $14.4 billion at December 31, 2017. At September 30, 2018, June 30, 2018 and December 31, 2017, the Bank also held a $0.1 billion long-term U.S. Treasury Note classified as trading.

The Bank's short-term liquidity portfolio, which is comprised substantially of overnight interest-bearing deposits, overnight federal funds sold, overnight reverse repurchase agreements, U.S. Treasury Bills and U.S. Treasury Notes with short remaining terms to maturity, totaled $12.3 billion at September 30, 2018, compared to $13.9 billion at June 30, 2018 and $14.5 billion at December 31, 2017.

The Bank's retained earnings increased to $1.042 billion at September 30, 2018 from $1.008 billion at June 30, 2018 and $942 million at December 31, 2017. On September 25, 2018, a dividend of $16.2 million was paid to the Bank's shareholders.

Additional selected financial data as of and for the quarter and nine months ended September 30, 2018 (and, for comparative purposes, as of June 30, 2018 and December 31, 2017, and for the quarters ended June 30, 2018 and September 30, 2017 and the nine months ended September 30, 2017) is set forth below. Further discussion and analysis regarding the Bank's third quarter results will be included in its Form 10-Q for the quarter ended September 30, 2018 to be filed with the Securities and Exchange Commission.

About the Federal Home Loan Bank of Dallas

The Federal Home Loan Bank of Dallas is one of 11 district banks in the FHLBank System, which was created by Congress in 1932. The Bank is a member-owned cooperative that supports housing and community development by providing competitively priced loans (known as advances) and other credit products to approximately 825 members and associated institutions in Arkansas, Louisiana, Mississippi, New Mexico and Texas. For more information, visit the Bank's website at fhlb.com.

(1) Investments consist of interest-bearing deposits, securities purchased under agreements to resell, federal funds sold, trading securities, available-for-sale securities and held-to-maturity securities.

(2) As of September 30, 2018, June 30, 2018 and December 31, 2017, total regulatory capital represented 4.96 percent, 4.83 percent and 4.77 percent, respectively, of total assets as of those dates.

(3) Net interest income is net of the provision for loan losses.

Contact Information:

Corporate Communications

Federal Home Loan Bank of Dallas

fhlb.com

214.441.8445