- March 21, 2024

- Greg Hettrick

FHLB Dallas Increases Funding for First-Time Homebuyer Down Payment Program

Spring selling season for single-family homes is just around the corner, and we’ve got some good news for homebuyers concerned about rising mortgage interest rates and housing prices: We’ve made a significant increase in funding for our down payment and closing cost assistance program for first-time homebuyers for 2024.

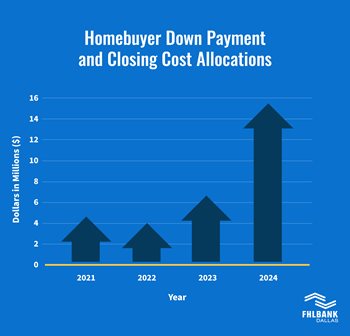

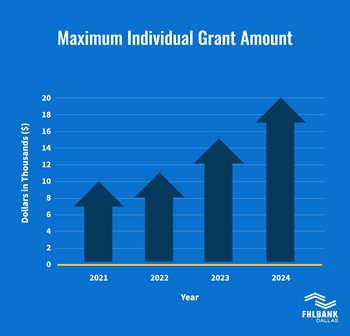

This year we have allocated $15.5 million in Homebuyer Equity Leverage Partnership (HELP) grants — up 139 percent over our 2023 funding of $6.5 million. HELP assists qualified first-time homebuyers with down payment or closing costs. Individual homebuyers, who must apply through one of our member institutions, can now qualify for as much as $20,000 toward their down payment, up from $15,000 last year.

This added funding is available as potential homebuyers straddle the fence on whether to buy amid interest rate and pricing headwinds.

Simmons Bank, an FHLB Dallas member, has been actively using HELP to assist first-time homebuyers in Arkansas.

“We’ve seen firsthand how HELP down payment assistance enables people in our communities to buy a home and put down roots in a neighborhood,” Sharmane Andrews, senior vice president of regulatory and consumer affairs at Simmons Bank, tells us. “It’s an incredibly impactful grant.”

The National Association of Realtors (NAR) noted recently that contract closings on existing home sales were on the upswing in February, at their highest point since August 2023, so the housing market may be thawing. NAR Chief Economist Lawrence Yun, speaking with Bloomberg Markets recently, said this news was encouraging after home sales were at a 30-year low in 2023, but he also noted that first-time buyers are struggling to come up with the down payment.

What is worrisome is that cash offers are at a nearly 10-year high, he said, which can push first-time buyers out of the running for a home as cash often is king.

In a situation like what Mr. Yun describes, our down payment assistance program can make a huge difference in helping someone overcome the down payment hurdle and become a first-time homeowner.

Certainly, there are challenges. Sellers are reluctant to list their homes for sale if they are enjoying an interest rate far below today’s current rates, but homebuilders have started ramping up new construction, which should help some with pent-up demand from would-be buyers.

We are encouraged that our big boost in HELP funds will be a catalyst for affordable homeownership for first-time homebuyers this year. Connect with one of our participating HELP members to begin your journey, and join us in supporting housing affordability.

Greg Hettrick is senior vice president and director of Community Investment at FHLB Dallas.