- June 10, 2019

- Bob Wang

Check Your LIBOR-SOFR Transition List

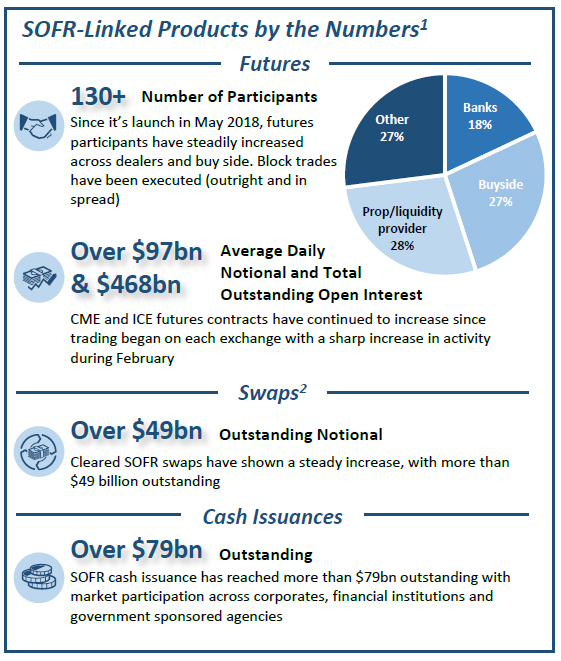

It has been a year since the Federal Reserve Bank of New York began publishing the Secured Overnight Financing Rate (SOFR) daily, which makes it a good time to take a look at where we are in the LIBOR-SOFR transition and the key milestones that have been reached.

As a refresher, the London Interbank Offered Rate (LIBOR) is the basic rate of interest used in lending between banks on the London interbank market. It is also used as a reference for setting the interest rate on other loans. The benchmark is expected to be phased out by the end of 2021 and replaced by SOFR as the alternative reference rate for U.S. dollar derivatives and other financial contracts. Over the last year, multiple SOFR-linked products have been introduced into the marketplace, representing an estimated amount of more than $7 trillion in cash and derivative products.

The Alternative Reference Rates Committee (ARRC) is a committee with a broad range of representation across the financial services industry and is responsible for ensuring an orderly transition from LIBOR to SOFR. The committee released final recommended contractual fallback language for fixed rate notes and syndicated loans in April 2019 to assist financial service companies with that transition.

Fallback language is contractual language that specifies the rate that will be used if the current reference rate is unavailable. Most fallback language in contracts originated before 2017 does not account for LIBOR phasing out completely, but rather addresses a temporary unavailability of LIBOR. This type of fallback language is insufficient to address a situation where LIBOR may be permanently unavailable.

The ARRC recently published guidance regarding fallback language to address the following items:

- Ensure contracts continue to function as closely as possible to what was initially intended by the parties

- Minimize any potential transfer of value between the parties when the fallback takes effect

The ARRC recommendation is composed of three components:

- Trigger events: Define the circumstances under which references to LIBOR in a contract will be replaced with an alternative reference rate

- Replacement benchmark: Identify the rate, or waterfall of rates, that would replace LIBOR following a trigger event

- Spread adjustment: An adjustment added to the replacement rate to account for differences between LIBOR and the replacement benchmark

You may view additional information on fallback language recommendations on the New York Fed's website.

At FHLB Dallas, our goal is to provide you with the necessary information on the LIBOR-SOFR transition simply and directly. To facilitate that goal, we have created a web page dedicated specifically to the LIBOR-SOFR transition and it is periodically updated with information of interest to financial institutions.

We've recently added a checklist that will provide you with a starting point for preparing your institution for the LIBOR-SOFR transition.

In addition to providing you with a starting point for preparing your institution for the LIBOR-SOFR transition, the checklist may also provide some guidance on augmenting your developing or existing plan.

Be on the lookout for a brand new SOFR advance that FHLB Dallas will be offering in the second half of 2019. For more information or questions about the LIBOR-SOFR transition, contact FHLB Dallas' Member Solutions department.

Bob Wang is a banking strategy analyst at the Federal Home Loan Bank of Dallas