- May 06, 2021

- Zimri Hunt

More Certainty Returns to CRE Industry as COVID-19 Infections Decline

What’s Ahead for Industrial, Multifamily, Retail and Hospitality Sectors

The COVID-19 pandemic was a “reset” for the commercial real estate (CRE) industry rather than a typical recession, although the pandemic likely will reshape the market for years to come.

Now about 14 months into the pandemic, optimism has returned to many sectors as infections and deaths decline in the United States, and vaccine rollouts appear to be gaining traction.

“We have a hopeful eye toward a 2021 recovery,” said Anthony Graziano, CEO of Integra Realty Resources (IRR), a nationwide CRE firm that specializes in valuation and advisory services. Mr. Graziano made his comments during a recent Federal Home Loan Bank of Dallas webinar featuring a panel of IRR experts discussing trends in the CRE space.

“COVID-19 wasn’t a typical contraction,” he said. “It was really a one-time economic event that will reshape a lot of the longer-term trends over the next 10 to 15 years.”

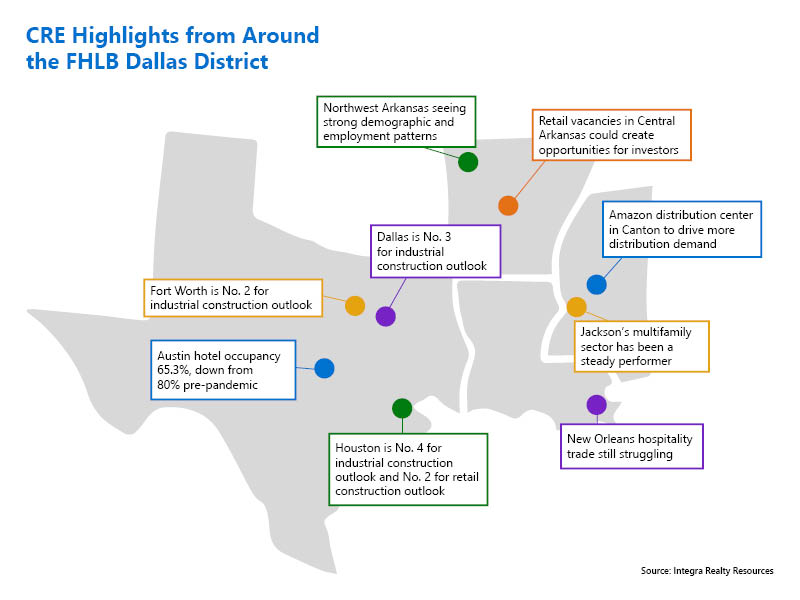

The industrial and multifamily markets saw muted negative impacts from the pandemic. Industrial benefited from the continued push into e-commerce, which began before the pandemic. Multifamily was strong going into the pandemic, and CRE experts have been pleasantly surprised by its continued strength.

The industrial sector has been a strong performer for several years as the country’s love of e-commerce remains unsatiated, but some concerns are arising about development getting ahead of demand in certain markets. Rising steel prices could put a damper on construction starts going forward and push lease rates higher, while all panel participants echoed concerns that construction supply chains and costs could tip the scales of new construction feasibility.

Multifamily Strong but Some Cracks

Nationally, multifamily had 700,000 units under construction as the year ended, a number that should taper off as the single-family market draws people from apartments to homes, and as deliveries, which started in 2019, come to market.

As rents begin to dip as a result of the exodus to single-family homes, that could ultimately draw people back into apartments as turbocharged home price increases are squeezing first-time homebuyers and negatively impacting affordability.

“Although we expected a stutter-step in the multifamily markets as we headed into the third quarter (of 2020), we saw active underwriting and active transactions throughout the United States,” Mr. Graziano said.

There was a slight decrease in the share of multifamily property mortgages late on their payment, to 1.7 percent in April from 1.8 percent in March, according to a Mortgage Bankers Association (MBA) report on April CRE delinquencies.

Office Market Challenged

The office market took a hit in major urban markets where huge increases in sublet space hit the market. The MBA reported that office property missed payments were up 0.2 percentage points to 2.6 percent in April.

“This ultimately will sort itself out, in our view, with a flight to quality,” Mr. Graziano said. “Institutional investors will migrate into Class A assets. Even in core markets there probably will be good discounts, but we haven’t seen them yet.”

He predicted some markets will face double-digit vacancies. The office market will need about a two- to three-year “reset” and then Mr. Graziano said he expects it to return to pre-pandemic conditions, assuming the economy continues to recover.

Retail and Hospitality to Rebound

Retail and hospitality remain a mixed bag depending on the market and the type of product.

Hospitality properties remain stressed in much of the country while leisure hospitality in destination markets should see an uptick this summer as families spend their stimulus checks on vacations, IRR experts said. Business travel and conventions have yet to return, though, and that has stressed markets that rely heavily on business travel such as New Orleans and Austin.

By balance due, 20.2 percent of mortgages secured by lodging properties were delinquent in April, down from 20.5 percent from March, according to the MBA. Over the same time frame, retail delinquencies were at 9.3 percent for the month, down from 9.5 percent.

Zimri Hunt is a Vice President and Director of Strategic Planning and Member Solutions.